What is Decentralized Copy Trading (DCT)?

Decentralized Copy Trading (DCT)

What is Copy Trading in the world of Cryptocurrency?

Crypto copy trading is a trading strategy that allows investors to automatically copy the trades of another trader, known as a signal provider.

The whole concept of crypto copy trading revolves around the idea of identifying successful traders and mimicking their actions. Unlike regular trading, copy trading doesn't focus on identifying market trends or attempting complex trading strategies. Instead, the automated software simply looks at what another trader is doing and does the same thing. Users can set variables such as capital amounts, maximum profit rate, and maximum loss rate before they agree to follow a trader.

Centralized Copy Trading

To understand decentralized copy trading, we must first understand centralized copy trading. Copy trading on Centralized Exchanges (CEXs) or centralized copy trading has been around for a while and is a familiar concept to many traders.

Centralized copy trading works by connecting your trading account to a centralized exchange that offers the service. Once you have connected your account, you can select a signal provider to copy. The exchange will then automatically execute the same trades as the signal provider in your account.

Here are the steps involved in centralized copy trading:

Create an account on a centralized exchange that offers copy trading.

Deposit funds into your account.

Search for a signal provider to copy.

Select the signal provider and set the amount of funds you want to allocate to copy them.

The exchange will automatically execute the same trades as the signal provider in your account.

The fees for centralized copy trading vary from exchange to exchange. However, they typically range from 0.05% to 0.2% of the amount of each trade that is copied. Several centralized exchanges offer copy trading, including Binance, Bybit eToro, KuCoin, BingX, Pionex, PrimeXBT, Bitget…

Centralized copy trading can be a convenient and low-risk way to trade cryptocurrencies. However, there are also some problems associated with centralized copy trading:

Number and caliber of signal providers: On centralized exchanges, the number of signal providers is small and their capabilities are hard to assess. As a result, it is challenging to identify a trader on centralized exchanges whose trading style suits your needs.

Transparency: One of the reasons why it is difficult to verify the abilities of traders on centralized copy trading platforms is that the data on these platforms is not public or transparent. When you choose to use centralized copy trading, you are essentially trusting the platform to provide you with accurate information about the traders you are copying, without any way to verify this information yourself.

Psychological: Ideally, the traders you find on centralized exchanges to copy are highly skilled. However, knowing exactly how many people are copying them can affect their performance or trading behavior in ways that benefit them or the exchange.

Decentralized Copy Trading: The Game-Changer

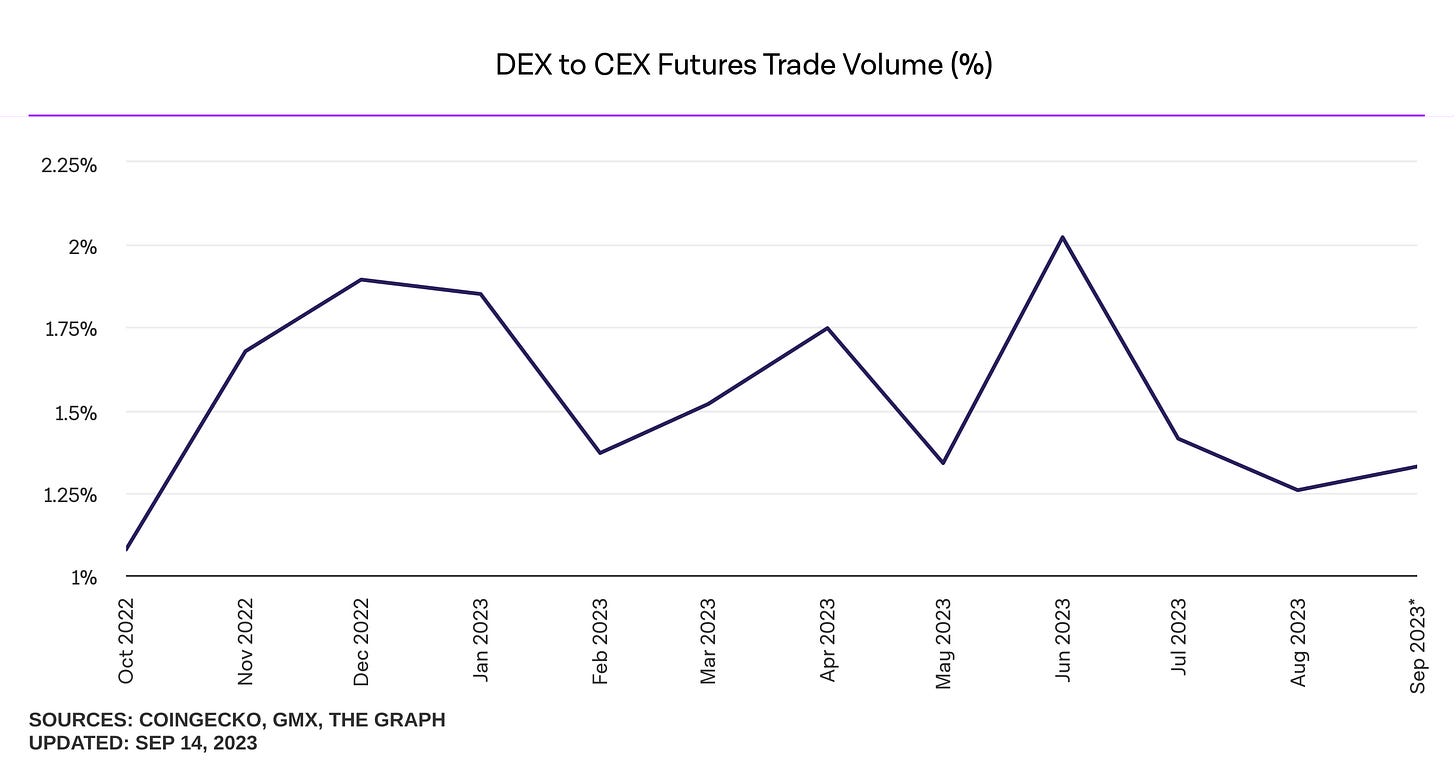

Since the collapse of FTX, an increasing amount of traders have abandoned centralized exchanges in favor of on-chain alternatives. Decentralized perpetual exchanges have seen a massive increase in cumulative trading volume and user activity in the past 1 year, despite a bearish macro environment and no new liquidity flowing into DeFi on a broader scale.

Decentralized perpetual trading is one of the few sectors in DeFi with product market fit. Decentralized perpetual futures exchanges have the potential to revolutionize the financial ecosystem by addressing inefficiencies and risks associated with traditional trading methods.

The rapid growth of perpetual futures exchanges has led to the development of decentralized copy trading, which aims to address the limitations of centralized copy trading while leveraging the inherent advantages of decentralized exchanges.

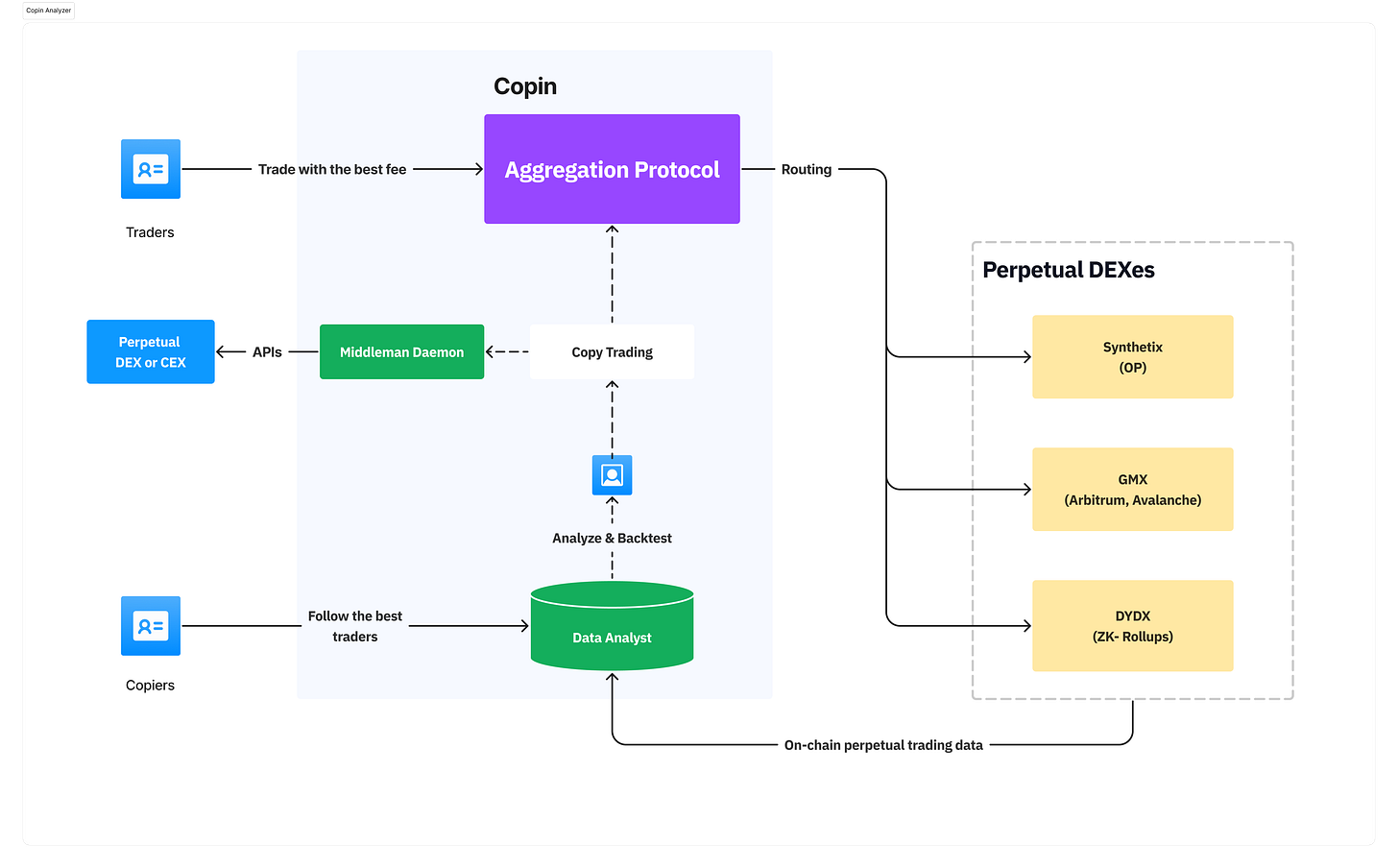

Decentralized copy trading is a method where investors replicate the trades of successful on-chain traders. This allows inexperienced or busy traders to benefit from the expertise and strategies of established traders, potentially improving their investment performance.

Here's how Decentralized Copy Trading overcomes the limitations of centralized copy trading (while taking advantage of the inherent benefits of copy trading):

Number and caliber of signal providers: The number of traders along with good traders will increase as Traders can trade with the best fee on on-chain perp DEXs.

Trader Selection: Copiers now have more options to choose experienced traders, or strategies that suit their wishes.

Transparency: You can now select and analyze traders without having to trust a centralized exchange. All trading activities, including entry and exit points, are recorded on the blockchain, ensuring transparency.

Data Analyst: This transparent and diverse data source allows you to start analyzing on-chain traders in your own way.

Smart Contracts: Smart contracts on a blockchain automatically replicate the selected trader's trades in the follower's account.

Security: Since funds remain in the follower's control, there's a reduced risk of fraud or mismanagement by intermediaries.

Decentralization: No central authority manages the copy trading platform, reducing the risk of censorship or downtime.

Overall, decentralized copy trading aims to democratize trading by giving users access to proven trading strategies while maintaining control of their funds and data. Decentralized copy trading will be a fully decentralized & community-driven model.

Some benefits of copying on-chain traders.

Overcoming FOMO: Copy trading helps combat impulsive and irrational trading decisions driven by the fear of missing out. By mimicking the moves of seasoned traders, you can tap into their disciplined approach and avoid hasty decisions.

Time-saving: Copy trading reduces the need for extensive market monitoring, analysis, and manual trade execution. By copying skilled traders, you can trade more passively and save time on research and execution.

Flexibility: Copy trading platforms offer customization options for trade size, risk management, and asset allocation. This flexibility allows you to tailor the experience to your needs, goals, and risk appetite while benefiting from the expertise of others.

Transparency: Copy trading provides access to detailed information about the historical performance, risk levels, and portfolio composition of the traders being followed. This transparency enables informed decision-making based on your risk tolerance and investment objectives.

Decentralized copy trading represents a new era in crypto trading, where trust, transparency, and autonomy are paramount. It empowers traders and investors by providing a secure and efficient way to engage with the cryptocurrency market.

Stay tuned with Copin Analyzer to explore the latest advancements in decentralized copy trading and the tools we offer to help you succeed in this dynamic landscape.

About Copin Analyzer

Website: https://copin.io/

Launch App: https://app.copin.io/

Docs: https://docs.copin.io/

Twitter: https://twitter.com/copin_io

Discord: https://discord.gg/jaJu8USARd